*This blog article was originally written in Japanese and has been translated by AI. From the Sumu-lab Editorial Team

Hello!Today’s post is a pricing analysis for the Phase 2, First Round Sale of Branz Tower Osaka Umeda, which turned into a lottery frenzy during the previous Phase 1 sale.

I didn’t win the lottery for Branz Tower Osaka Umeda either, but recently, even if the price of a new high-rise condo in central Osaka goes up, it’s becoming increasingly difficult to win. A few years ago, even popular properties sometimes allowed for first-come, first-served purchases depending on the unit. Now, even with substantial price increases, lotteries often have multiple to hundreds of times the applicants—sometimes even exceeding 100x. Times have truly changed.

I first noticed the shift during the Harumi Flag launch. At first, most units had 2–3x lotteries, but soon, those ratios jumped into the double and triple digits. Since then, not only in Tokyo but also in central Osaka, lottery-based sales have become the norm for new high-rise condos.

That said, not all new condos are subject to lotteries. Market dynamics vary greatly between central and suburban areas, and between tower and mid-rise buildings. In the suburbs, you’ll often see ads like “Visit the model room and get a 3,000 yen QUO card!” or “1 million yen cashback on fees!” or “Major negotiations underway!!”

Speaking for myself, it’s not that “you can’t win new condos,” but rather that only “new condos with high resale potential or those that seem profitable” are hard to win. So if you keep losing lotteries for new condos, it might be better to consider nearby pre-owned condos in terms of future asset value—especially for first-time homebuyers, I highly recommend not focusing solely on high-demand new tower condos.

Also, we’re seeing a rise in newly built condos that undergo “steep price increases” or “limited number of units for sale” during the sales period, but end up continuing to sell even after completion. There are many cases where newly built but unsold units and resale listings for never-inhabited properties overlap and stagnate. That’s why I think you need to be cautious about buildings with too much flipping activity.

In short, if a property isn’t truly being bought by actual end-users, there’s a high risk when it comes time to sell.

Now, let’s get back to the price analysis for the Phase 2, First Round Sale of Branz Tower Osaka Umeda!

—Past articles cover design, shared facilities, and Phase 1 pricing. Be sure to check them out—

【大阪】ブランズタワー大阪梅田 アンダー販売価格と1期販売価格がまさかの値上げ無しの同一価格!?オススメ出来るか?!【すごろく】

目次

Property Overview

- Property Name: Branz Tower Osaka Umeda (ブランズタワー大阪梅田)

- Access:

- 3-min walk from Nakazakicho Station (Osaka Metro Tanimachi Line)

- 7-min walk from Ogimachi Station (Osaka Metro Sakaisuji Line)

- 7-min walk from Temma Station (JR Osaka Loop Line)

- 12-min walk from Osaka-Umeda Station (Hankyu Kobe, Takarazuka, and Kyoto Lines)

- Total Units: 256 (92 units in the “under-the-table” sales) – Under-sale ratio: 36%

- Floor Plans: 1LDK to 3LDK

- Private Area: 44.13㎡ to 138.33㎡ (largest unit sold under-the-table was 197.90㎡)

- Floors: 38 stories

- Completion Date: January 2027

- Handover Date: March 2027

- Public Sales Start: Mid-April 2025

- Model Room: Late February 2025

- Seller: Tokyu Fudosan Holdings Corporation

- Construction: Nishimatsu Construction Co., Ltd.

- Management: Tokyu Community Corporation

- Notes:

- Parking: 107 spaces (92 indoor tower-type, 14 indoor flat, 1 outdoor flat)

- Bicycle Parking: 512 spaces (157 indoor flat, 355 indoor mechanical)

- Motorbike Parking: 6 indoor

- Scooter Parking: 47 indoor

Phase 2, First Round Sale Overview

- Preview Event: June 28 – September 7

- Price Finalization & Application Period: Early to mid-September

- Lottery: Mid to late September

- Handover: Late March 2027 (planned)

Phase 2, First Round Expected Pricing

- Average Price per Tsubo: Approx. ¥7.8 million/tsubo

- Lowest Price per Tsubo: ¥4.7 million/tsubo

- Lowest Unit Price: ¥65.9 million

- Highest Price per Tsubo: ¥15.6 million/tsubo

- Highest Unit Price: ¥749.9 million

Last weekend, I confirmed the expected prices. As of now, the pricing is still vague—low to mid-level floors are expected to be in the ¥100 million range, while high floors are roughly estimated at “early ¥100 million” or “late ¥100 million.”

What immediately came to mind was:

“Even though the under-the-table and Phase 1 sales are over, they’re still gauging customer reaction with tentative prices?!”

Recently, it’s become common for new condos to raise prices with each sales phase. While some tower projects have adjusted prices up and down, I do wish developers would just release the full pricing openly. If they keep reacting to customer feedback with price changes, buyers will simply compare with other properties and potentially walk away—or cancel even if they win the lottery.

If they truly want to sell to end-users, it would be better to release a limited number of units at the same price as before. (Well, maybe that’s how other developers—not Tokyu—handle it…)

This time, prices have been raised overall compared to the under-the-table and Phase 1 sales. Although all units in Phase 1 sold out via lottery, it appears some cancellations occurred. These canceled units are now being resold at roughly the same price as before.

Aside from canceled units, most prices have increased by several million yen. If the unit you were targeting has gone up significantly, it’s definitely a tough pill to swallow. That said, there are more units available in this round.

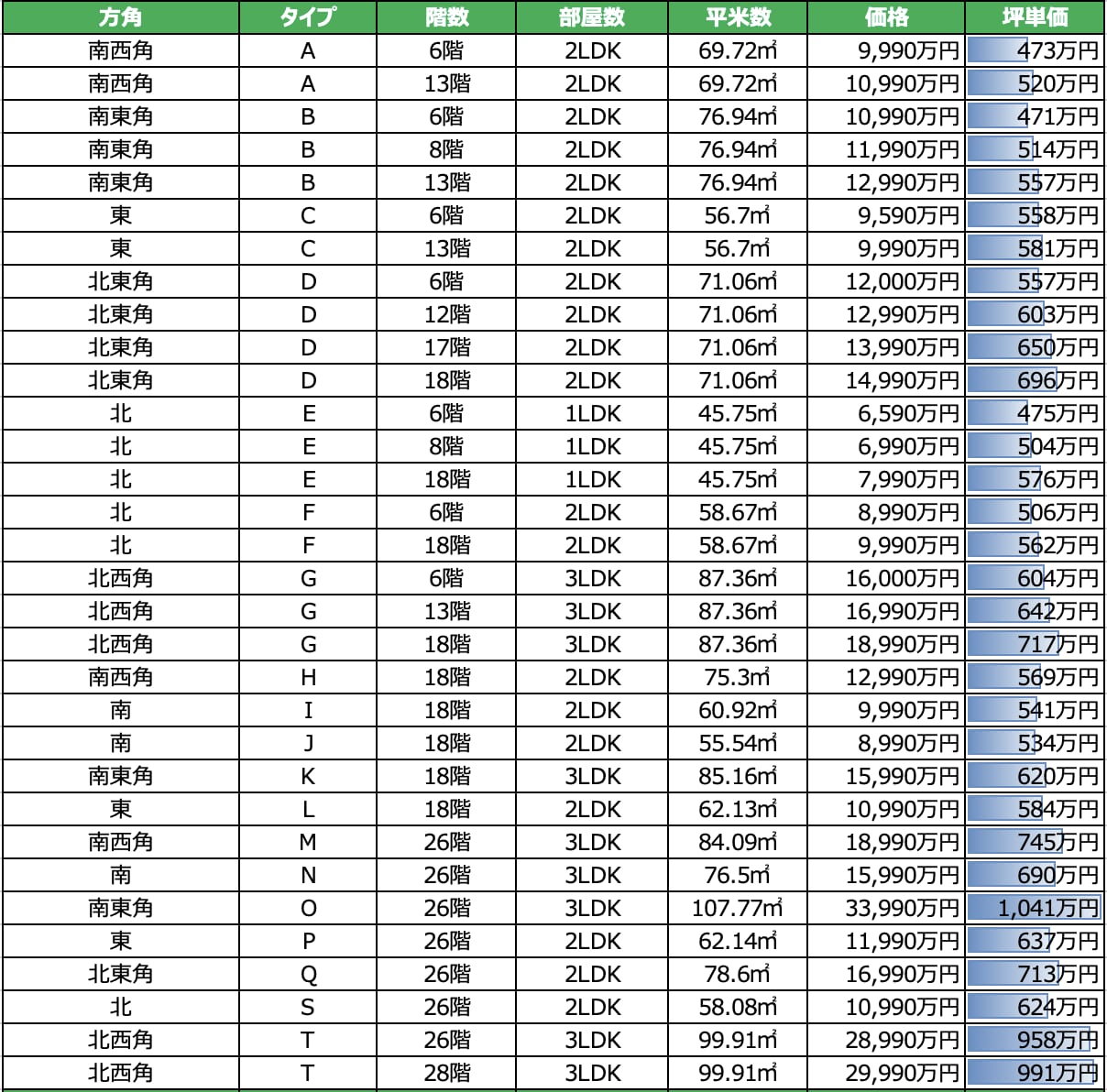

Here’s the price chart:

※ Click the chart to enlarge.

※ Prices listed in increments of ¥9.9 million (e.g., “¥90 million range” = ¥99.9 million).

※ For same type units with identical pricing in ¥10 million increments, the lower floor is marked as ¥X.59 million and higher floors as ¥X.99 million.

※ Premium floor ranges are shown with the maximum estimate (e.g., late ¥200 million = ¥299.9 million; early ¥200 million = ¥249.9 million).

This time, even 1LDK units are available, so gross prices start from the ¥60 million range. Though these are on lower floors, they may appeal to those who prioritize functionality over views, such as:

“I live alone, work late, don’t care much about views, and want to live somewhere convenient while making use of shared facilities.”

Units with no view on lower floors go for under ¥5 million/tsubo, which could be surprisingly affordable when compared to large pre-owned tower condos in Kita Ward.

Mid-level floors range from mid-¥5 million to ¥6 million/tsubo, similar to properties like “Branz Tower Umeda North” and “The Parkhouse Nakanoshima Tower.”

The northwest corner “G-type” saw a ¥30+ million increase compared to Phase 1—quite painful for those who were eyeing it. Still, comparing it with other towers like “The Parkhouse Nakanoshima Tower (corner unit)” or “Grand Maison Shin Umeda Tower THE CLUB RESIDENCE (corner unit),” the pricing is comparable, and as a new tower in Kita Ward, it’s likely to remain popular.

Notably, the southeast corner on the 26th floor (higher than Kitano Hospital) exceeds ¥10 million/tsubo, and the northwest corner is approaching that level. At these prices, you could also be considering “Brillia Tower Dojima” or “Grand Front Osaka Owner’s Tower.”

Premium & Shinra Suite Floors

Phase 1 vs. Phase 2, First Round Pricing Comparison

This phase’s prices are still preliminary and may differ from final prices. But here’s a rough comparison:- Most units increased by around 10%. Popular corner units saw about 20% increases. ※ The 26th-floor southeast corner unit previously exceeded ¥300 million, so pricing remains stable given the overall price ceiling.

- The northwest corner G-type, which had 150x lottery odds last time, dropped 3 floors in this phase but rose by up to ¥32.6 million.

- Southwest corner on premium floors (34F), higher than Park Tower Umeda’s 31F, rose by as much as ¥59.8 million.

I’ll keep an eye on how these price levels affect lottery odds going forward.

※ Click chart to enlarge.

※ Blue labels on the left = Phase 1 prices, green labels on the right = Phase 2, First Round prices.

Conclusion

Since these are still provisional prices, we’ll revisit the analysis once official pricing is released.Interestingly, this round has:

No Unit Limit!

Previously, there were lottery advantages based on unit limits, but this time there’s no cap, so I’m curious to see how this impacts the draw.

Due to significant price hikes, the investment appeal may be reduced, which could lower lottery odds slightly. That said, with multiple cancellations in the last round, the developer may be targeting investors with this broader release.

For real end-users applying with home loans, you can only apply for one unit—meaning you’re naturally at a disadvantage compared to investors who may apply for several.

(If you apply for multiple and win multiple, you must either buy them all or cancel them all.)

Still, recent examples show that even a unit raised by ¥100 million in Park Tower Osaka Dojimahama drew 70x lottery odds (with advantage included), and a ¥400 million hotel-level unit had 50x. Given the popularity of new high-rise condos, I believe this property will remain highly desirable. If you haven’t requested materials or visited the model room yet, it’s definitely worth a look!

That’s all for today. See you in the next post!

【Notice 1】Sugoroku LINE Official Account

On this LINE account, I regularly share standout resale listings I find—especially those I think are great deals or personally want to buy.While I mainly focus on new condos in my blogging, resale condo inquiries have increased due to the rising prices. I plan to cover both new and used properties.

If you’re interested in a resale condo, feel free to message me on LINE for a quick reply. Please add me as a friend!

☆Click here to add me as a friend☆

【Notice 2】Sumu-lab Consultation Counter

If you’re in Osaka Prefecture, I can provide advice on both new and resale condos. I can also offer guidance if you’re selling your property, based on my own experience—please feel free to reach out!

Don’t forget to check out the next blog post!

I also share condo news on Twitter—please follow me!

Sugoroku Twitter

- Request for Information(Japanese)

-

この記事を読んで 【ブランズタワー大阪梅田】 が気になったら資料請求してみよう

[From the SumuLab editorial department] The information in this blog post is as of the date of posting.Please refer to the Lifull Homes for current sales information.

スムラボ記事

- 【大阪】ブランズタワー大阪梅田 アンダー販売価格と1期販売価格がまさかの値上げ無しの同一価格!?オススメ出来るか?!【すごろく】

- 【大阪】2025年以降の大阪タワマン年表と再開発!まだまだ大阪のマンションは値上がする!?【すごろく】

- 【ブランズタワー大阪梅田】1期販売価格はアンダー販売からのまさかの値下げ?!これもブリリアの影響か…【すごろく】

- 【大阪】【ブランズタワー大阪梅田】待ちに待った2期1次販売は値上?今期オススメ出来るか?!【すごろく】

- 【ブランズタワー大阪梅田】新年早々に販売開始!2期2次販売価格考察【すごろく】

Bulletin board of the property mentioned in the article (Japanese)

- シティタワー西梅田(検討スレ) | (住民スレ) | (まとめ)

- グランドメゾン新梅田タワー(検討スレ) | (住民スレ) | (まとめ)

- 北浜ミッドタワー(検討スレ) | (住民スレ) | (まとめ) | (スムレビ)

- ローレルタワー梅田ウエスト(検討スレ) | (住民スレ) | (まとめ)

- グランドメゾン新梅田タワー THE CLUB RESIDENCE(検討スレ) | (住民スレ) | (まとめ) | (スムラボ) | (スムログ) | (スムレビ)

- グラングリーン大阪(検討スレ) | (住民スレ) | (まとめ) | (スムラボ)

- シエリアタワー中之島(検討スレ) | (住民スレ) | (まとめ) | (スムラボ)

- ザ・パークハウス 大阪梅田タワー(検討スレ) | (まとめ) | (スムラボ)

- ブランズタワー大阪梅田(検討スレ) | (住民スレ) | (まとめ) | (スムラボ)

- Brillia(ブリリア)Tower 北浜(検討スレ) | (まとめ) | (スムラボ)

記事にコメントする